Know Exactly What Investors Want

If you want to get in the room—and stay there—you need three things: clarity, confidence, and traction. Skip the jargon. Investors have heard it all before. What they need is a sharp understanding of what you’re doing, why it matters, and who’s already proving it works.

Storytelling beats spreadsheets in the early moments. Not because the numbers don’t matter—they do—but because numbers without context are forgettable. Tell them why you started. Tell them about the problem that won’t let you sleep at night. Weave that into a simple story that leads to your solution. Once you’ve got their attention, the data will land harder.

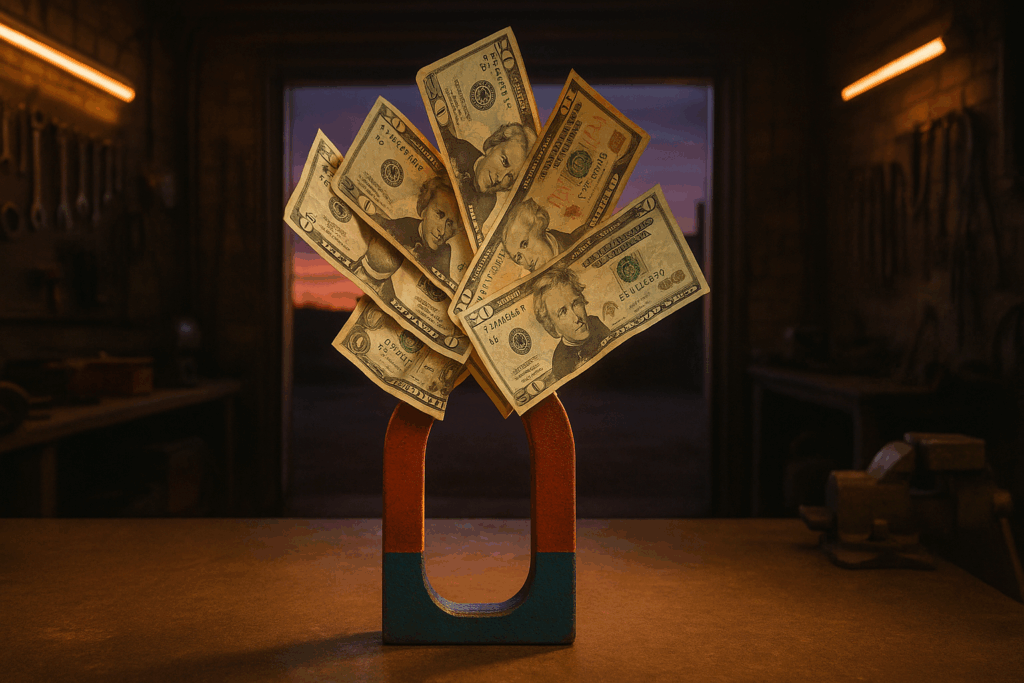

Also, be clear about what you’re pitching. Are you selling a clever widget, or the business engine behind it? There’s a big difference. One’s a product. The other’s a company. Investors back systems, not one-off hits. Be sure you’re presenting a vision that scales, with structure that holds. That separation is what builds trust—and opens wallets.

Investors don’t have time for fluff. They want to know what problem you’re solving—immediately.

So start here: What’s broken? Maybe it’s bloated logistics slowing down local deliveries. Maybe it’s rising customer churn in fitness apps. Whatever it is, hit hard and stay focused.

Then shift gears. Show them the fix. Your product, your platform, your process—clean, specific, no buzzwords. How does it make life better or profits bigger? Don’t drown them in features. Keep the spotlight on impact.

And here’s the kicker—why now? Maybe the market finally matured. Maybe tech enabled something that wasn’t possible two years ago. Or maybe you just hit a tipping point others missed. Create urgency. Show them why delaying isn’t just a mistake—it’s a missed opportunity.

Step 2: Prove the Market is Real

Convincing investors means showing there’s a real, substantial market waiting for your product or service. Skip vague estimates and surface-level stats—this step is about grounded, verifiable proof of opportunity.

Size Matters—But Accuracy Matters More

Inflating the total addressable market (TAM) is a red flag for seasoned investors. Be clear, conservative, and honest when calculating your numbers:

- Break down your TAM, SAM (Serviceable Available Market), and SOM (Serviceable Obtainable Market)

- Cite credible sources—say where the numbers come from

- Avoid generic multi-billion dollar estimates without context

Investors don’t expect you to own the world from day one. They want to see where you can realistically win, and how big that win can be.

Quantify the Demand or Pain Point

Market size means little without evidence people actually want—or desperately need—what you’re building. Demonstrate relevance and resonance:

- Refer to existing solutions and their limitations

- Share user surveys, waitlists, pilot program feedback, or case studies

- Highlight user behavior patterns that point to a clear market gap

Showing unmet demand is often more compelling than showcasing a crowded space.

Know Your Users Inside-Out

Investors invest in insight as much as opportunity. Understanding who your customer is—and what drives them—is key.

Ask yourself:

- Who exactly is your target user/customer? Define personas clearly.

- What motivates their behavior or purchase decisions?

- How do they currently solve the problem?

- Why would they switch to your solution?

Deep user knowledge separates ideas from investor-ready businesses. The more data and first-hand insights you bring to the table, the stronger your pitch becomes.

Step 3: Show Traction that Matters

Traction is the first real signal that you’re building something people actually want. Early adopters—whether they’re customers, waitlist signups, or pilot partners—aren’t just nice to have; they’re proof. If people are using your product, talking about it, or better yet, paying for it—that’s your lead story.

Got pilot results? Show data: usage patterns, retention, NPS, or anything quantifiable that hints at stickiness. If you’ve got sales, even early ones, break them down. Are they repeat? Are they growing? Investors don’t expect $10M ARR on day one, but they expect something real. Vague phrases like “lots of interest” or “great feedback” don’t land unless they’re backed by hard metrics.

The trick is to share momentum without sounding like a hype machine. Frame wins honestly, show what you’ve learned, and outline where that traction is taking you next. Fast learning and smart iteration matter just as much as raw numbers. That’s what keeps investors leaning in.

Step 4: Team Strength is Non-Negotiable

Investors aren’t just betting on your product—they’re betting on your team. And that bet needs to look smart. Your team should have a balance of execution muscle and strategic insight. Not just titles, but proven grit.

If someone’s led a go-to-market push at a scrappy Series A company, say that. If another teammate built scalable tech while juggling deadlines and scarce resources, make that clear. Show patterns of impact, not paper credentials.

What makes the mix right is overlap with your market’s needs. If you’re solving a logistics problem and your team has firsthand experience with supply chains, frustrated customers, or enterprise sales—that’s gold.

And you don’t stop there. Show you’ve got the judgment to build around the blind spots. Maybe you’re looking to add growth marketing muscle, or deeper industry expertise next quarter. A hiring roadmap grounded in your growth plan signals maturity. You’re telling investors: we know what we’ve got, we know what we need, and we’re building with intention.

Step 5: Know the Numbers Cold

Investors won’t chase vague promises anymore—they want clarity, fast. That starts with knowing your core metrics cold: burn rate, CAC (Customer Acquisition Cost), LTV (Lifetime Value), gross margin, all of it. You’re not pitching a dream. You’re pitching a machine that runs on math.

Burn rate matters because it tells them how long your runway is. CAC and LTV show if your growth is sustainable. If your LTV isn’t comfortably higher than your CAC, you’ve got a fire to put out. If you’re pre-revenue, fine—but back it up with user growth, low churn, or strong engagement.

Now, onto the ask. Be specific. How much are you raising? And what exactly is it for? “Growth” isn’t a line item. Break it down. Product development, headcount, marketing experiments—spell it out. If you’re putting 45% toward marketing, explain where, why, and how it connects to outcomes.

You’re not expected to predict every cent, but you are expected to present a plan that’s intentional. Numbers speak louder when they’re tied to strategy, not fluff.

Step 6: Prepare for Interrogation

By the time you hit the Q&A, you’ve done the pitch. Now comes the real test: can you stay sharp under pressure? Investors will poke at your edges—they’re thinking about risk, not just upside.

Expect tough, recurring questions about competitors, growth challenges, and scalability. Who else is in your space? Why won’t they eat your lunch when you try to grow? What’s stopping copycats? If your answers are vague or defensive, you’ll bleed credibility fast.

Don’t spin. Investors don’t need you to be perfect—they need you to be honest. If there’s a weak spot, acknowledge it, then show them how you’re addressing it. The goal isn’t to appear invincible. It’s to show you’re self-aware and in control.

And if the conversation takes an unexpected turn—roll with it. A good founder doesn’t panic when the narrative pivots. Guide it back to your core strengths, your traction, your growth path.

Think of this stage not as defense, but as dialogue. You’re not just answering questions—you’re deciding who gets a seat on your journey.

Step 7: Close Like a Pro

You’ve built the pitch. You’ve faced the questions. Now finish strong.

Start by circling back to your mission—and make it land. Remind investors not just what your startup does, but why it matters. Tie it to your ambition: the scale, the impact, the long game. This isn’t the time to shrink. Be crisp. Be bold. Leave them knowing exactly what they’re buying into.

Next, hand off a pitch deck that’s tight, clean, and speaks for itself. No jargon frills. No font chaos. Just the essentials: problem, solution, traction, roadmap, team, numbers. Treat it like a leave-behind resume for your business.

Finally, nail the follow-up. Timing matters. Wait 24–48 hours—no sooner, no longer—and send a short, direct email. Recap interest, attach the deck, and outline next steps clearly. Avoid spammy persistence. Use channels they already prefer (email still rules). Follow up twice—politely—and know when to walk away.

Pro closers balance confidence with courtesy. They plan contact like they plan content. Do the same.

Bonus Tip: Explore Beyond Traditional VC

Not every venture needs (or wants) traditional venture capital. These days, smart founders are mapping their funding route based on stage, risk tolerance, and growth intent. Enter alternative capital: angel networks, crowdfunding platforms, accelerators, and strategic grants are no longer Plan B—they’re often plan smart.

Angel networks give you capital plus experience, and they tend to move fast. Crowdfunding—whether rewards-based or equity-based—can double as early product validation. Accelerators bring structure, mentorship, and a network if you’re still finding your footing. And don’t ignore regional grants or government-backed programs—they may be unsexy, but they’re nondilutive and often underutilized.

The key is knowing what type of support fits your phase. Seed-stage? Angels or accelerators might be your move. Pre-product? Crowdfunding can test your signal. Scaling fast? Maybe a mix of growth partners and revenue-based finance makes more sense.

Get more tactical details in Exploring Alternative Funding Sources for Startups.

Final Thoughts: Crafting a Memorable Pitch

A great pitch isn’t about theatrics or flash—it’s about precision, purpose, and presence. As markets shift and funding gets more competitive, founders need to deliver more than just a good idea. They must deliver it clearly and confidently.

What Makes a Pitch Stand Out

Your pitch should embody three core qualities:

- Clarity: Cut the jargon. Define your problem, solution, and business model in plain terms.

- Credibility: Back claims with real traction, data, and insight. Let results speak louder than ambition.

- Connection: Make investors care. That means a well-structured narrative anchored by urgency and human impact.

Refine Like You Mean It

Think of your pitch as a living product—it needs constant testing and iteration. Treat feedback not as critique, but as fuel for refinement.

- Practice regularly with trusted advisors or fellow founders

- Adjust based on reactions and repeat questions

- Update your deck and delivery as your company evolves

Quiet Confidence Wins

Confidence doesn’t come from volume or bravado—it comes from preparation and self-awareness.

- Know your numbers without a cheat sheet

- Anticipate tough questions and answer without defensiveness

- Show belief in your team, your product, and the journey ahead

The best pitches aren’t about persuasion—they’re about clarity, alignment, and shared vision. When you’re focused, grounded, and informed, investors take notice.