Why Alternative Funding Matters Now

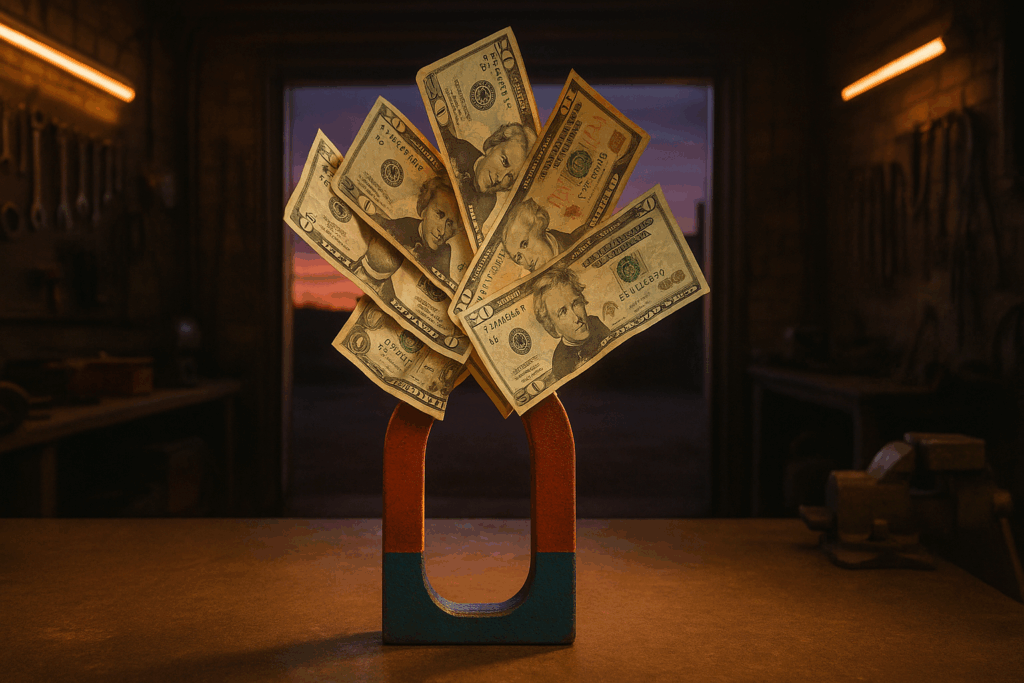

For years, venture capital was seen as the gold standard. But in 2024, startups are learning that blindly chasing big checks can come at a steep cost—diluted equity, rigid expectations, and timelines that often favor investors over builders.

Today, the funding landscape is strewn with new realities. Interest rates have climbed. Traditional firms are tightening terms. And economic instability has pushed founders to get smarter, leaner, and more creative with how they raise money. VCs may still play a role, but they’re no longer the only game in town.

What’s rising instead? Flexible capital. Founder-first deals. Money that comes without pressure to 10x in 18 months. The appeal here isn’t just control—it’s durability. From crowdfunding and revenue-based financing to grants and strategic partnerships, startups are diversifying their capital stacks the same way they diversify customer channels or product lines.

That shift isn’t just tactical—it’s cultural. Founders want options. And in this market, the ones who understand how to stitch together the right mix of funding stand a better chance not just to launch, but to last.

Crowdfunding: More Than Just Hype

Crowdfunding isn’t just for quirky gadgets and passion projects anymore—it’s a serious funding channel for startups that want to raise capital without giving away too much too soon. Two main tracks dominate here: rewards-based and equity crowdfunding.

Rewards-based platforms like Kickstarter and Indiegogo work best if you’ve got a tangible product, a killer pitch video, and a timeline that doesn’t fall apart. You’re offering early access or perks, not ownership. It’s fast and relatively low-risk, but it demands smart marketing and airtight logistics.

Equity crowdfunding, through platforms like Republic and SeedInvest, offers the opposite: investors put in money in exchange for a piece of your business. This model fits startups ready to scale with a compelling vision and solid paperwork. You’re building a cap table, not just collecting donations, so legal and financial prep are non-negotiable.

Whichever model you choose, trust is your currency. A clear value prop, strong visuals, real-world traction, and regular updates before and during your campaign are what move the needle. You’re not just asking for money—you’re building a belief system around your idea.

Some of the best campaigns didn’t break records—they built tight-knit early communities. Others fell flat from missed shipping dates or vague goals. Crowdfunding shines brightest when it’s focused, transparent, and built on real momentum before the first backer clicks in.

Crowdfunding isn’t easy money. But for founders who can tell a story and show up consistently, it’s a legit launch pad.

Revenue-Based Financing (RBF)

Revenue-Based Financing (RBF) is a straight-shooting model: in exchange for upfront cash, startups commit to paying back a percentage of future revenue until a set cap is reached. It’s not a loan in the traditional sense, and it doesn’t dilute equity. The faster you grow, the faster you repay. If growth slows, payments adjust accordingly.

RBF works best for businesses that have steady, predictable income—think SaaS, direct-to-consumer brands, and subscription-based models. These companies can give up a slice of their monthly revenue without putting operations at risk.

One major draw? Speed. RBF providers often make decisions faster than VCs or banks, and founders hang on to control. There are no board seats, no endless pitch meetings, and no cap table disruptions.

But it’s not risk-free. If growth stalls or margins are thin, those revenue cuts hurt more every month. And because the capital isn’t cheap—think higher effective interest rates than loans—it can bite back over time.

Used wisely, RBF can be clean, fast, and founder-friendly. Used recklessly, it just trades one kind of pressure for another.

Angel Syndicates and Micro-Investors

Startups live or die by who’s in their corner. While friends and family can help you take the first step, scaling growth often requires smarter capital—money that brings muscle. That’s where angel syndicates and micro-investor networks come in.

Platforms like AngelList and Seedrs have removed the friction. They let you access pooled investments from groups of angels who often co-invest through a lead backer. This lead isn’t just writing a check—they’re usually an experienced founder or operator with skin in the game and strategic value to offer. Get the right one on your cap table and you’re not just getting funds—you’re getting someone who’s been in the trenches.

The real edge, though, is network access. Syndicated angels often open doors to follow-on rounds, hard-to-reach customers, and industry experts. But this kind of capital isn’t totally hands-off. You’ll still need to pitch hard, handle group due diligence, and meet expectations on communication. Keep it clean—updates, metrics, progress. Trust goes both ways.

And a word of caution: if you’re mixing formal syndicate platforms with informal deals—think solo angels or small group investments—do your homework. Ask for references. Validate track records. Write everything down. Light agreements lead to dark problems when things go sideways.

Tapping into investor networks is less about the dollar amount, more about the leverage they bring. Choose wisely, and those early believers might just be your unfair advantage.

Grants and Non-Dilutive Funding

Grants aren’t just for researchers in lab coats—startups across industries are catching on. Whether you’re building clean tech, developing agri-innovation, or boosting community health, there are government and private programs designed to fund specific sectors, no equity required. Agencies like the NSF, DOE, and NIH in the U.S., or Horizon Europe abroad, offer sizable awards for companies solving big problems. Private foundations and corporate-backed funds also run sector-based competitions with similar goals.

Then there’s R&D tax credits. These aren’t flashy, but they can quietly add thousands back to your budget. If you’re building novel tech or solving a technical challenge, odds are you qualify—many startups just don’t realize it. Same goes for innovation awards, which usually blend funding with networking and credibility.

Locating the right opportunities starts with alignment. Use grant databases (like SBIR.gov or GrantForward), tap into startup-oriented newsletters, and track funding cycles from your target agency. Tightening your application means making clear what’s innovative, how it works, and why it matters now. Keep it laser-focused, with defined milestones and a practical use of funds.

Timing is not optional. Many programs have small windows—miss a deadline, and you’re out for the year. Also, most grants come with strings: reporting, audits, and timelines. Build those into your ops plan. Free money is never truly free, but for founders willing to play the game, it’s one of the cleanest capital sources around.

Corporate Venture Arms and Strategic Partnerships

When startups partner with corporate venture arms or strike strategic funding deals, it’s not just about cash—it’s about alignment. Large companies use these investments to scout innovation, plug tech gaps, or keep an eye on rising trends that might disrupt their sector. For founders, that means funding often comes with strings attached—good ones, if you play it right.

Corporate funding tends to follow industry interest. A fintech startup chasing Series A might find a perfect partner in a traditional bank trying to modernize its stack. A climate tech venture might land support from an energy giant looking to signal sustainability. It’s all about narrative fit: your mission needs to bolster their strategy.

But don’t confuse interest with independence. Some of these deals can limit your exit options or box you into exclusivity arrangements that kill future partnerships. Structure matters. Review every term—rights of first refusal, equity clauses, IP ownership. Strong legal counsel isn’t optional at this level.

That said, the long play here isn’t pure capital. It’s access. Big companies open doors to supply chains, customer bases, and regulatory insight you can’t buy. The smart money is in seeing corporate funding as a growth multiplier, not just a financial boost.

Accelerator and Incubator Capital

Startups chasing their first serious momentum often look to accelerators and incubators for a reason: they’re not just writing checks—they’re handing over blueprints. The best programs offer a bundle deal: capital, mentorship, accountability, and a dialed-in network you can’t build overnight. Think of it like strapping a rocket to early-stage execution—if you’re ready to move fast.

Top programs worth a hard look include Y Combinator, Techstars, 500 Global, and SOSV. Each has distinct flavors: YC focuses on speed and scale, while Techstars leans heavily into mentorship and local ecosystems. For social impact or industry-specific ventures, consider niche options like Village Capital (impact) or BioGenerator (biotech).

But the catch? Most accelerators want a piece of the pie. Equity stakes, usually 5%–7%, are the norm. That’s your trade-off: move faster with top-tier backing, or keep your cap table clean and go slower. Some new players, like the Calm Company Fund or Entrepreneur First, are pushing flexible models that stagger equity or provide alternative structures—but they’re not a fit for everyone.

Choosing the right fit starts with basics: what stage are you in, and what’s your vertical? Hardware founders have different needs than SaaS teams. Solo technical builders need different support than growth-stage refiner crews. Be honest about where your gaps are, and pick a program that fills them with more than just warm intros. Because at the end of the day, speed matters—but not if it takes you off course.

Community-Owned Financing (DAOs, Tokenization)

Decentralized finance is opening new doors for startups to tap into capital without going through traditional gatekeepers. With innovations like DAOs (Decentralized Autonomous Organizations) and tokenization, early-stage companies now have tools to turn their communities into backers—and sometimes, into stakeholders.

Raising Funds On-Chain: The Basics

Startups can now raise funds directly on the blockchain by launching:

- Token Sales: Offering digital tokens in exchange for capital, often tied to platform utility or future access.

- DAOs: Community-managed organizations where members pool funds and vote on how capital is allocated—used increasingly for startup investments.

These models enable:

- Global participation from early supporters

- Transparent funding and governance mechanisms

- Rapid access to liquidity (in some cases)

Know the Risks and Rules

While community-owned financing is exciting, it’s far from risk-free. Founders must carefully navigate:

- Regulatory Uncertainty: Depending on the jurisdiction, tokens may be treated as securities, invoking compliance and legal scrutiny.

- Volatility: Crypto markets are inherently unstable, which can affect the real value and utility of funds raised.

- Community Management: With collective ownership comes complex decision-making and expectations.

Best Practices Include:

- Conducting smart contract audits before fundraising

- Having a clearly defined utility or governance structure for tokens

- Avoiding over-promise/under-deliver cycles to maintain trust

Where It’s Worked—and Where It Hasn’t

Some startups have thrived using on-chain financing:

- ConstitutionDAO raised over $40 million from internet users aiming to buy a historic document, showcasing collective power—even though the bid failed.

- Mirror.xyz, a Web3 publishing platform, used token-based models to fund writers and developers through community hashtags and NFTs.

But missteps are common:

- Unvetted projects that raised too fast crumbled under regulatory pressure or poor execution.

- Overly ambitious DAOs have faced backlash when leadership or roadmap transparency was lacking.

Bottom Line

Community-backed capital can be revolutionary—but only when approached with transparency, strong infrastructure, and a long-term mindset. For the right projects, this model goes beyond money; it creates believers, not just backers.

Choosing the Right Mix

The best funding strategy isn’t just about getting cash—it’s about picking the kind of capital that aligns with where you’re headed. If your goal is aggressive scale with a big exit, traditional venture—or strategic corporate backing—might fit the bill. But if you’re focused on sustainable growth and long-term control, then revenue-based financing, grants, or even community-led funding can get you there without diluting ownership or compromising vision.

Diversifying your funding sources doesn’t mean creating chaos. It means being intentional. Maybe you combine an early-stage accelerator for momentum, a small grant for R&D, and a crowdfunding round to build customer loyalty. The key is to understand what each capital type brings—and what it takes. Avoid stacking too many layers if they pull you in different directions.

Think long-term resilience, not just short-term runway. Replacing burn-rate anxiety with options means having capital that flexes with your business, not against it. Be strategic early, and you won’t have to scramble later.

Investment Trends in the Startup World: What’s Hot

Startups used to chase venture capital like it was the only game in town. Not anymore. In today’s landscape, capital is still flowing—but it’s smarter, more selective, and coming from more diverse directions. Investors are leaning hard into sectors like climate tech, AI-driven platforms, and health innovation—but not just for the buzz. Founders with real traction, defensible IP, and a path to profitability are the ones getting term sheet offers.

Pre-seed and seed rounds are seeing reinvention. SAFE notes and rolling funds are more common, especially in founder-led rounds. Micro-funds and niche syndicates are stepping up, often outmaneuvering larger firms with slower decision cycles. As a result, the VC ecosystem is decentralizing, fast.

Another solid trend: impact investing is growing teeth. LPs want returns, sure—but increasingly with a conscience. Think ESG frameworks, mission-driven mandates, and startups proving they can solve problems and turn a profit.

Bottom line? Startups that understand the new investor mindset—and position accordingly—will move faster. Big hype is out. Real value, solid teams, and flexible capital strategies are what’s hot.

You can deep-dive into these shifts in Investment Trends in the Startup World: What’s Hot.

Final Thoughts

Alternative capital isn’t a consolation prize—it’s a playbook move. The smartest founders in 2024 aren’t chasing prestige, they’re building stamina. Going outside traditional VC isn’t about settling for less. It’s about staying nimble, keeping control, and aligning funding with business reality.

Pitch decks alone don’t cut it anymore. You need a plan—clear traction, smart distribution, a legit grip on your numbers. Whether you’re bootstrapping alongside a revenue-sharing line, or stacking a government grant with angel capital, the power is in how you structure your stack.

The long game is simple to say, harder to do: build something real, fund it wisely, and keep momentum flowing without burning out or giving too much away. That’s not flashy. It’s just good strategy.